Runa & Runa Send

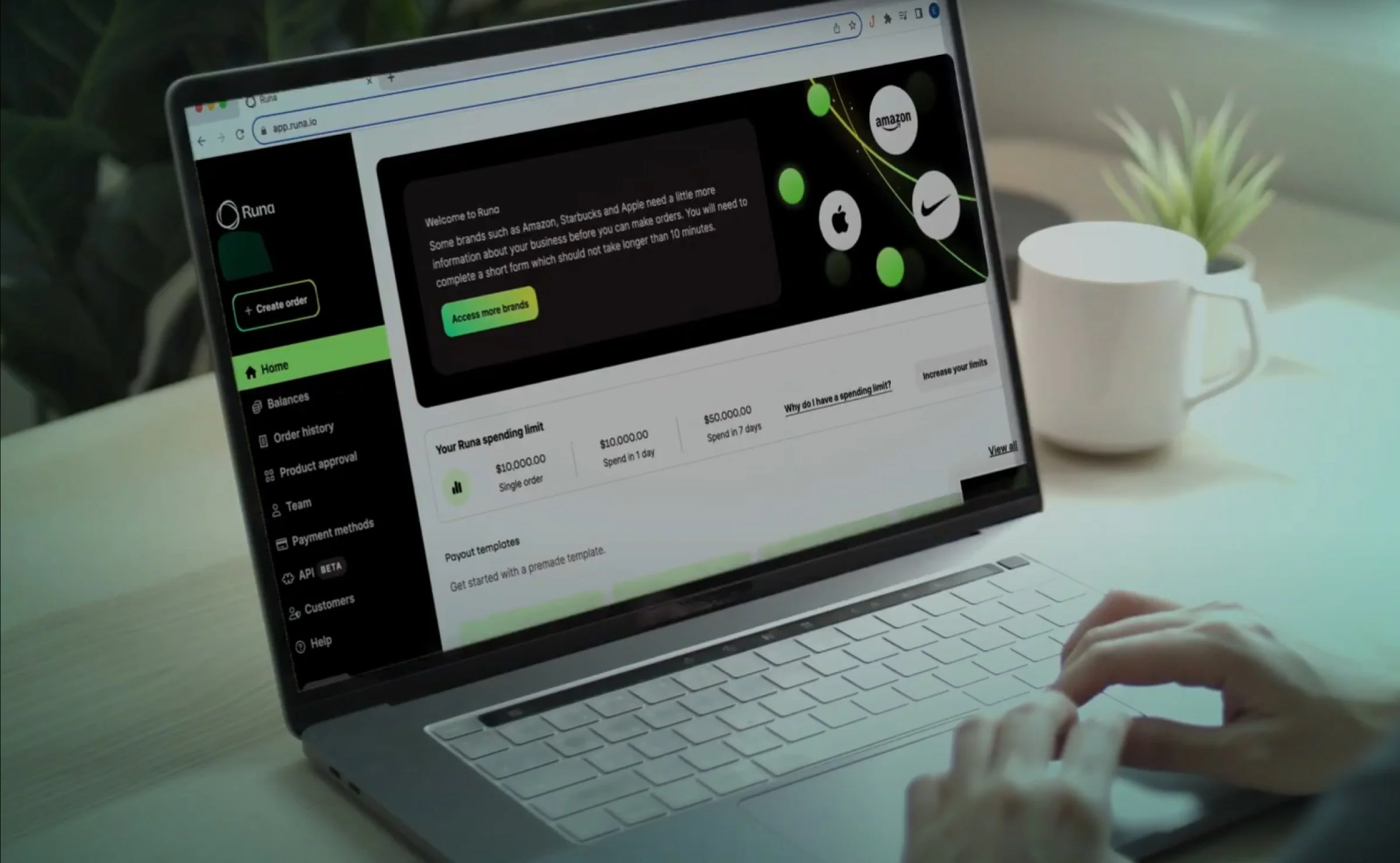

Runa is a smart solution for distributing gift cards at scale. They stand out for providing access to 700+ brands, bulk discounts of up to 25% off, and the ability to reclaim unspent value on expired gift cards.

I was brought in to Runa to help them find growth. The current enterprise, sales driven model was working, however sales cycles were long, clients requested custom builds which was resulting in quick and dirty additions to the product and code base.

Runa Send is a free to use digital rewards platform that helps businesses reward and incentivise the people they care about.

By retaining the discounts that Runa has been able to negotiate with the brands they offer as rewards, we were able to offer our platform to more customers to use for free.

Differentiating ourselves on ease of use and features rather than purely discount which is essentially a race to the bottom. This allowed us to capture more of the market and acted as a tool to help up sell to companies as their rewards & incentives programs grow.

I was hired as lead product designer in the growth team tasked with finding new growth. I was working in a cross functional team with PM and Lead Dev. We were able to capture a new market segment while reducing the resources to onboard new clients and brands. Making our entire business more scalable.

Understanding the problem & Defining success

When I started I wanted to define and align on what we meant by growth as well as what we thought the number 1 problem was preventing us from achieve it, so I ran a Kick off meeting with Engineering lead, PM, CEO, CRO & HOP.

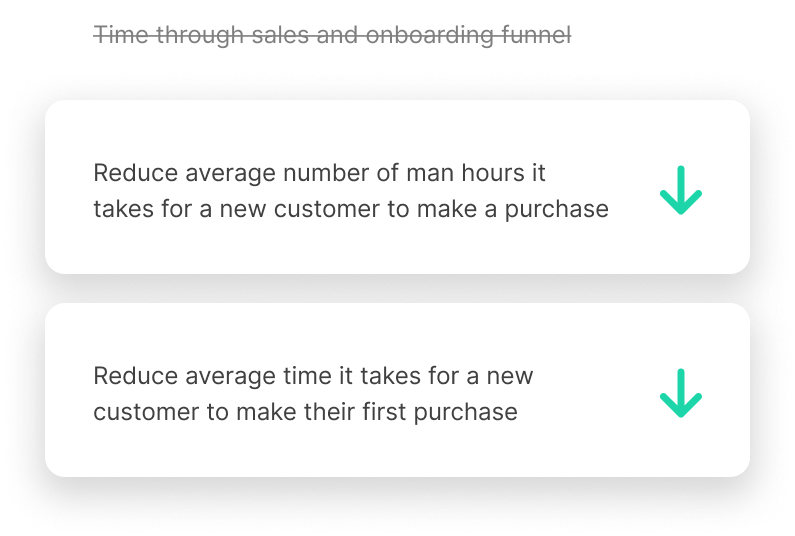

The CRO suggested that the product teams metric was increasing the speed that potential customers moved through the sales process. Despite initially highlighting that the product team couldn’t directly impact this metric, I decided to commit to this metric and move forward rather than going back and forth.

The problem that was agreed upon was that, a high % of customers would sit in the sales/onboard pipeline for a long time and require a lot of resources before become customers. This meant we couldn’t scale the sales operation.

Hypothesis & Experiments

We brainstormed ideas as to what might be causing customers to get stuck in the sales cycle, before aligning on one best guess. We assumed that the decision maker (CFOs, CMOs) weren’t confident enough in the ROI in order to sign the contract.

We then came up an idea that we thought would best solve this problem. “Show how easily ROI was calculated in the platform”. Created an experiment in order to test our hypothesis.

Ran our experiment with customers in the pipeline as well as brand new leads. The product team sat in on sales calls as well as ran additional interviews with potential existing customers.

Results

We synthesised the results together and updated our hypothesis. The results showed that our hypothesis was off by quite a bit. Not only that, but our understanding of our customers’ procurement process was entirely wrong.

One of the key insights that came out of our research was that potential customers were hesitant to start the procurement process or involve a decision maker as they themselves we’re sure of the value the product delivered.

It was previously believed that the sales team could provide demos and collateral to sufficiently close new customers and would often push for a meeting with a decision maker in order to try and get the client over the line.

Updating our Hypothesis

We hypothesised that if we could get potential customers to make a purchase they would see the value of the product and be more likely to convince their decision maker.

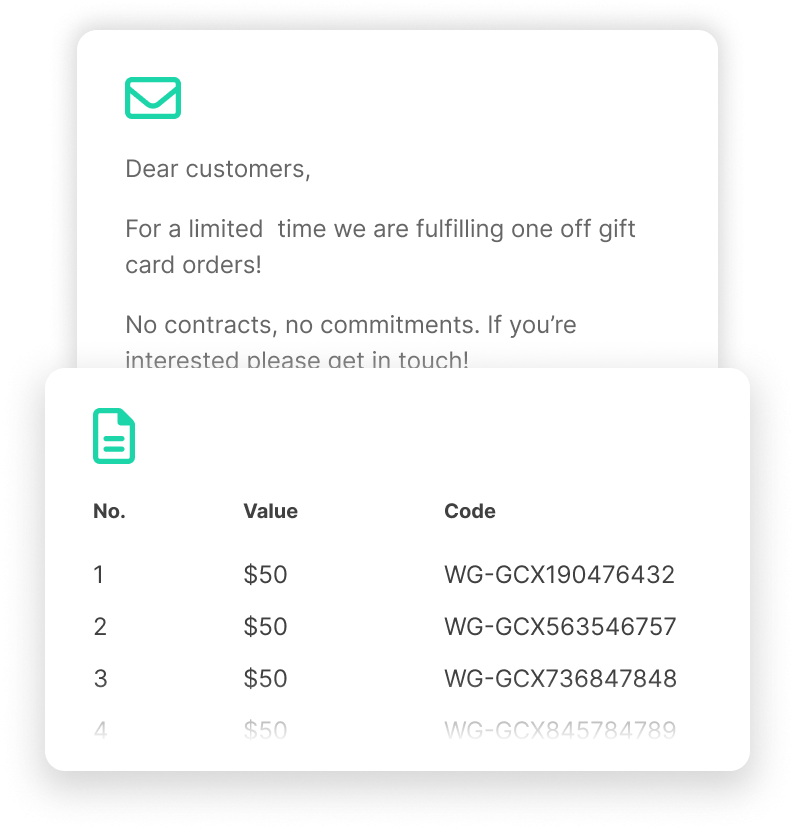

We decided to run and experiment where we sent a marketing email to potential customers in the pipeline who had recently shown interest in our product and offered to manually fulfilled orders.

Giving them access to our existing product wasn’t an option as our product required a lot of work to set up each client and had poor usability.

Analysing results - From the small sample size we ran the experiment with we were able to see that a majority were keen to progressed to a paid plan. We were also able to service smaller customers that we would have typically turned away due to the amount of recourses required to close, onboard and maintain each client.

Reframing the problem

Currently the sales process and onboarding process as well as the ongoing maintenance for each customer is extremely resource intensive due to the fact that the product doesn’t offer self onboarding, the user experience is poor and customers often demand bespoke features and integrations.

We want to reduce the time and number of man hours it takes for a customer to make their first purchase on the product.

User Segment

Choosing a user group to focus on first. - I generated a list of all our current and prospect customers and used Fiver to get information about their industry, company size, department that reached out etc. This helped us understand where we were already succeeding.

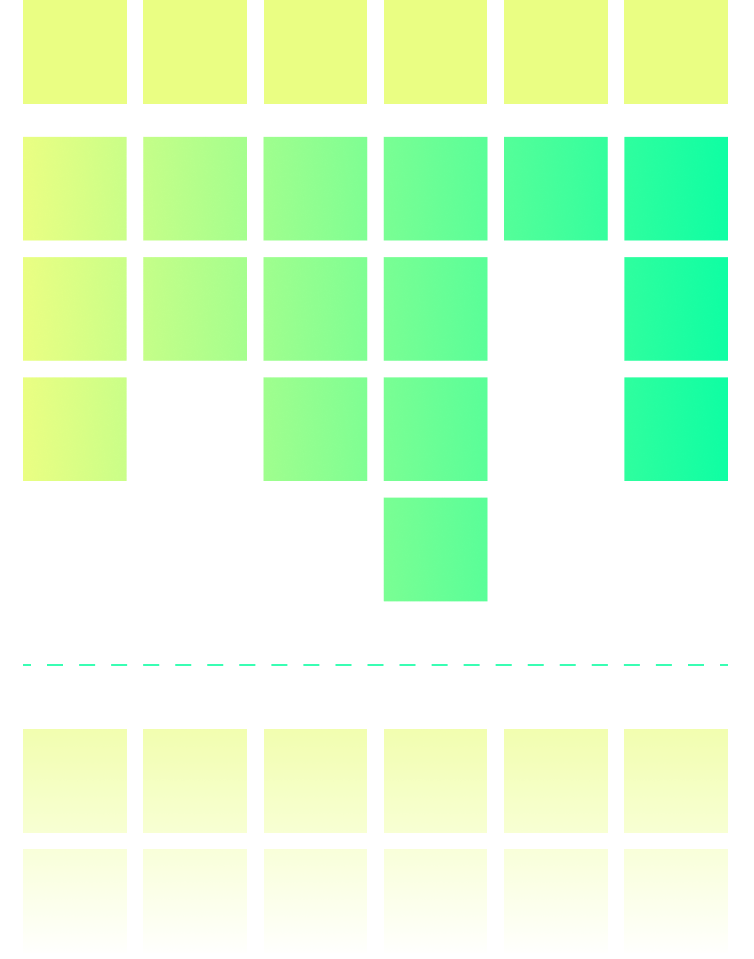

We saw that the majority of customers who expressed interest were SMEs (defined as 10 - 500 employees). This segment had been neglected by the business to date. Traditionally we’d been focused on large enterprise customers as they typically had the highest volume of gift cards sent per year. However there were fewer of them coming to us, they took longer to onboard often requiring custom builds.

We were able to do a market analysis to break the market into segments and show that there was a sustainable business model if we were to capture the SOM within the SME segment.

Hypothesis & experiments

We came up with the idea that giving SME customers an easy and quick way to set up a rewards or incentive program was the best way to solve our problem and achieve our metrics.

I put together a research plan to find out more about this segment as we didn’t know much about them and how their needs differed from enterprise customers.

I also created a fake landing page based on what we believed the MVP list of features were in order to serve this segment. This would be shown to research participants after an initial interview with the idea of testing a landing page (copy, graphics etc.) as well as to validate an MVP feature set.

We then conducted interviews with these users, pulling from our list of companies that had expressed interest through our marketing site, contacting people through linked, speaking to existing customers as well as using tools and services to recruit participants who fit our user group.

Analysing results

After synthesising our research findings we were able to refine our personas, list of features and marketing site.

These insights were then turned into tools and prompts that the product and marketing teams could align on and worth with.

SMEs cared less about APIs, FX and Department specific budgeting. But instead cared about a simple easy to use UX and Customisation of reward options and messages.

Coming up with a solution

Using the insights and prompts from our research I designed a number of workshops to outline at a high level what our product should do in order to best serve these customers.

From this ideal view of what the product could be we scaled back to what we believed was the MVP feature set.

Assumption mapping

We took time to brainstorm potential risks and outstanding assumptions we were acting on. Before ranking them on a risk matrix so that would could answer our riskiest assumptions first.

We then ran a range of experiments to answer our riskiest assumptions. Some of the experiments were marketing campaigns that led to false doors, further manual fulfilment of orders for customers in the pipeline and more interviews.

We also designed a google form to mimic an onboarding flow to test conversion.

Delivery

Once we had de-risked the solution sufficiently, I also started to design a low fidelity version of the product so we could do usability tests as part of our other interviews. Working with the cross-functional team to refine and work towards a higher fidelity.

After refining the usability of the product and building it we launched to a beta group of users which we would follow up with in interviews at set intervals.

Measure

We set up Mixpanel and Hotjar on the product so we could closely monitor user activity and behaviour.

We also conducted a number of interviews with customers after they had placed their first orders. We were also lucky enough to sit in on video calls where the customer would go through the entire journey through to placing their first order.

Findings:

Users would typically make a test order as their first order

Users would typically make a first order a week after signing up

Users would omit certain brands that didn’t align with their values

Users wanted more customisation around messages

Users wanted more in the way of presets and templates

Wanted permissions to restrict certain actions